ETH Price Prediction: Bullish Technicals Meet Strong Fundamentals

#ETH

- Technical Strength: ETH trading above key moving average with bullish MACD momentum suggests continued upward potential

- Institutional Demand: Record institutional accumulation and whale activity providing fundamental support for price appreciation

- Market Dynamics: Combination of technical resistance levels and regulatory developments requiring careful risk management

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

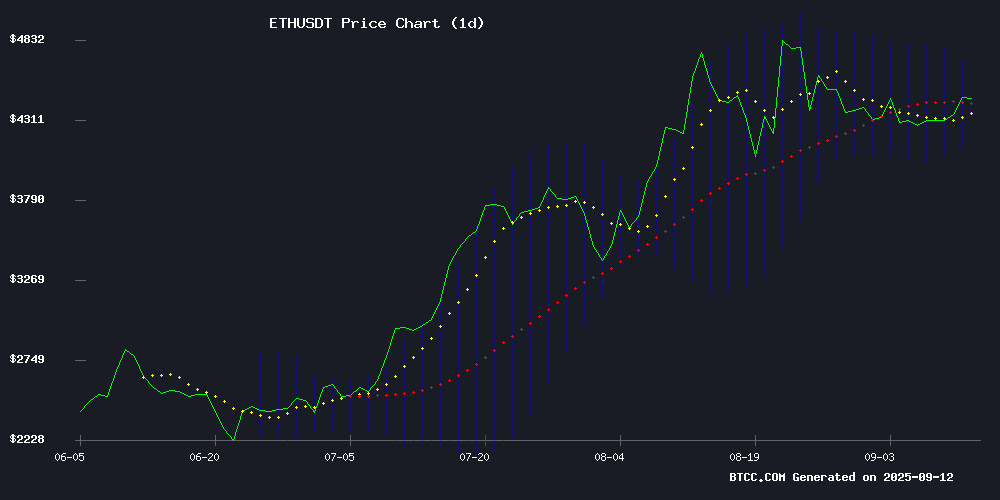

Ethereum is currently trading at $4,542.43, positioned comfortably above its 20-day moving average of $4,407.17, indicating sustained bullish momentum. The MACD reading of 127.51 versus its signal line at 107.15 suggests continued upward pressure, while the Bollinger Bands show ETH trading closer to the upper band at $4,657.28, signaling potential resistance ahead. According to BTCC financial analyst Mia, 'The technical setup remains constructive with ETH holding above critical support levels. The current positioning suggests room for further upside, though traders should monitor the $4,657 resistance level closely.'

Market Sentiment: Institutional Demand and Whale Activity Drive Optimism

Recent news flow surrounding ethereum paints a picture of robust institutional interest tempered by some operational challenges. Headlines highlighting record institutional demand, whale accumulation of $7.5 billion in ETH, and the growing $76 billion Real World Assets market create a fundamentally positive backdrop. However, incidents like the mass slashing event and exchange controversies introduce elements of caution. BTCC financial analyst Mia notes, 'The underlying institutional narrative remains powerfully bullish, though market participants should remain aware of the regulatory and technical challenges that continue to shape Ethereum's ecosystem development.'

Factors Influencing ETH's Price

Ethereum's Volatility in 2025 Highlights Risks and Alternatives

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, continues to dominate decentralized finance and blockchain innovation. However, its price volatility in 2025 underscores the inherent risks of speculative trading. Sharp market corrections and unpredictable gas fees exacerbate the challenges for investors seeking stable returns.

For those prioritizing consistent income over high-risk trading, cloud mining platforms like FY Energy offer an alternative. Their environmentally conscious mining contracts provide a lower-carbon approach to accumulating ETH and other digital assets without exposure to market swings.

The Ethereum network faces structural hurdles beyond price fluctuations. Despite its smart contract supremacy, network congestion and steep entry barriers persist even after multiple protocol upgrades. These factors may drive investors toward more predictable crypto yield strategies as the market matures.

Coinbase Accuses SEC of Damaging Public Trust Over Deletion of Gensler Texts

Coinbase has filed a legal motion against the U.S. Securities and Exchange Commission, alleging violations of the Freedom of Information Act. The crypto exchange claims the SEC's failure to preserve and disclose communications, including deleted text messages from former Chair Gary Gensler, has eroded public trust.

The SEC's Office of Inspector General confirmed the destruction of records, prompting Coinbase to seek federal court intervention. "This gross violation of public trust must never happen again," said Paul Grewal, Coinbase's chief legal officer. The case could undermine the regulator's credibility in future crypto enforcement actions.

Ethereum Validators Face Rare Mass Slashing Incident

Ethereum witnessed one of its largest slashing events since transitioning to proof-of-stake, with 39 validators penalized on September 10. The affected validators were linked to SSV Network, a decentralized staking platform designed to enhance security through distributed validator keys.

Blockchain data from Beaconchain reveals the incident as one of the most significant correlated slashings in Ethereum's PoS history. Validators incurred immediate ETH penalties, with potential additional losses from inactivity leaks. Infrastructure issues involving third-party staking providers—not protocol vulnerabilities—triggered the event, according to SSV Network's founder Alon Muroch.

The slashing highlights growing pains in Ethereum's validator ecosystem as staking services scale. While isolated, such events test network resilience and validator operator preparedness during critical infrastructure failures.

THORSwap Offers Reward for Return of Stolen Crypto Assets

Decentralized exchange aggregator THORSwap has launched a blockchain-based reward program after a security breach resulted in the theft of approximately $1.2 million in digital assets. Blockchain analyst ZachXBT identified the victim as John-Paul Thorbjornsen, founder of the altcoin project THORChain. The platform has publicly appealed to the attacker, offering a reward and legal immunity if the stolen funds are returned within 72 hours.

Initial reports from security firm PeckShield suggested a protocol-level exploit, but THORSwap CEO Paper X clarified the attack targeted only a personal wallet. The stolen assets included $1.03 million in Kyber Network tokens and $320,000 in THORSwap coins, with significant amounts later converted to Ethereum and transferred to secondary addresses.

Consensys Transfers 15% of LINEA Tokens to Insured Custodian Amid Price Volatility

Consensys has shifted 15% of its LINEA token holdings to a regulated custodian, underscoring institutional-grade security measures for digital assets. The move safeguards $9.45 million worth of tokens with insured storage while navigating post-airdrop market turbulence.

LINEA's 20% price decline since distribution raises questions about adoption timelines for Ethereum's Layer-2 solution. The custody arrangement combines regulatory compliance with risk mitigation—a growing priority for blockchain enterprises managing treasury assets.

As Consensys bets on Ethereum scaling solutions, its treasury strategy reflects maturing crypto asset management practices. The insured custodianship model may set precedents for other Web3 companies balancing growth ambitions with operational security.

Ethereum Strengthens on Whale Demand and Staking, But Resistance Looms

Ethereum extended its bullish momentum this week, trading at $4,529.48 after a 2.02% gain. Institutional interest has surged, with Ethereum investment funds now holding 6.5 million ETH—double April's levels. Large wallets holding 10,000 to 100,000 ETH have also expanded, surpassing 20 million ETH, signaling strong conviction among major players.

Record staking activity continues to tighten supply, with over 36 million ETH locked in validator contracts. While this bolsters Ethereum's long-term outlook, the sheer volume of staked ETH may limit near-term inflows if enthusiasm wanes.

Network metrics remain robust, with daily smart contract executions exceeding 12 million. DeFi transactions, stablecoin transfers, and token activity push transaction counts to historic highs, reinforcing Ethereum's dominance in decentralized finance and programmable applications.

Radiant Capital Hacker Moves $26.7M in Stolen ETH to Tornado Cash

The perpetrator behind the $51.5 million Radiant Capital hack has shifted another 5,933.3 ETH ($26.7 million) to cryptocurrency mixer Tornado Cash. CertiK Alert reports the funds were bridged to Ethereum and dispersed from three separate addresses.

October's 2024 breach saw attackers compromise a multi-signature wallet by infiltrating 3 of 11 signers, draining $55 million from lending pools. The initial exploit involved malicious contracts that tricked users into authorizing fraudulent transfers on Arbitrum and BNB Chain networks.

Security analysts warn this movement signals ongoing laundering efforts. The stolen assets originally included wrapped BNB, ETH, and stablecoins, with $32 million extracted from Arbitrum and $18 million from BNB Chain.

Consensys CEO Joseph Lubin Addresses Linea TGE Hiccups

Consensys CEO Joseph Lubin acknowledged technical challenges during the initial 55 minutes of the Linea token generation event (TGE), attributing the hiccups to demand exceeding projections by more than double. Despite overprovisioning resources by three times, the surge necessitated rapid scaling. "The Linea token economy has been birthed," Lubin declared, framing the launch as a pivotal milestone for Ethereum's ecosystem.

Linea, a zero-knowledge Ethereum Virtual Machine (zkEVM) rollup, promises low fees and ETH-denominated gas. The TGE debuted with mUSD as its core application token, backed by $50 million in liquidity from Etherex. Lubin emphasized the team's swift response, stabilizing the network after the initial strain.

Ethereum Price Surges: Institutional Demand Hits Record Highs, $5,000 Next

Ethereum has reclaimed the $4,500 mark as institutional investors accumulate the asset at record levels. The cryptocurrency now eyes a potential rally toward $5,000, fueled by sustained demand from both large funds and retail holders.

Fund holdings have reached an all-time high of 6.7 million ETH, while total wallet balances now stand at 20.6 million ETH. This accumulation trend, observed throughout 2025, signals conviction beyond short-term speculation.

Notably, growth spans wallets of all sizes—from retail addresses to those holding over 100,000 ETH. Such broad-based participation suggests deepening market maturity rather than concentrated positioning by whales.

Real World Assets (RWA) Market Surges to $76B as Institutions Embrace Tokenization

The Real-World Asset (RWA) sector is gaining momentum, with tokenized assets soaring 11% in the past week. The market capitalization now approaches $76 billion, while on-chain tokenized assets have doubled since January 2025 to a record $29 billion. What began as a niche experiment has evolved into a cornerstone of crypto adoption, driven by institutional demand.

Private credit dominates tokenized assets, accounting for over half of the total, followed by U.S. Treasuries at roughly 25%. Commodities, equities, and alternative funds make up the remainder. Institutions benefit from faster settlements, transparency, and access to new liquidity pools, while investors gain exposure to traditionally exclusive financial products. "Tokenization could democratize finance," says BlackRock CEO Larry Fink.

Ethereum remains the backbone of RWA tokenization, hosting more than 75% of the total value. Including stablecoins, the on-chain tokenized asset market swells to $307 billion, signaling a shift from experimental to mainstream finance.

Ethereum Whales Accumulate $7.5 Billion in ETH as Institutional Demand Surges

Ethereum's price action reveals a stealth accumulation pattern beneath its $4,200-$4,500 trading range. Approximately 1.7 million ETH—worth $7.5 billion—has been absorbed near the $4,300-$4,400 level, creating formidable support. Bitmine Immersion alone acquired over $1.1 billion worth of ETH, expanding its holdings beyond 2.1 million tokens.

Institutional fingerprints appear across multiple fronts. SharpLink Gaming redirected $379 million in USDC to Galaxy Digital, signaling potential further ETH accumulation. CME's Ethereum futures open interest hit record highs, with heavy institutional participation in short-term contracts. Exchange analytics show Binance processed the largest outflows during this accumulation phase, with withdrawn ETH carrying an average cost basis of $3,150—suggesting long-term holders are rotating out while new capital enters.

Technical analysts project a $6,500-$7,000 price target should ETH decisively breach the $4,500 resistance level. The current price of $4,411 sits comfortably above previous resistance zones, with whale activity providing substantial buy-side pressure.

Is ETH a good investment?

Based on current technical indicators and market fundamentals, Ethereum presents a compelling investment case. The cryptocurrency is trading above key moving averages with strong momentum indicators, while institutional demand continues to reach record levels. However, investors should consider both the opportunities and risks:

| Positive Factors | Risk Considerations |

|---|---|

| Price above 20-day MA ($4,407) | Approaching Bollinger upper resistance |

| Strong MACD bullish divergence | Regulatory uncertainty around exchanges |

| Record institutional demand | Network operational challenges |

| Whale accumulation patterns | Market volatility inherent to crypto |

BTCC financial analyst Mia suggests, 'For investors with appropriate risk tolerance and a long-term perspective, ETH's technical strength combined with growing institutional adoption creates a favorable risk-reward scenario, though position sizing should reflect the asset's inherent volatility.'